Nebraska’s Hidden Tax: Red Tape Regulation Harming Economic Growth

Introduction

Regulation is a two-way street. In one direction, when applied effectively, regulations ensure certain standards that keep consumers, workers, and employers safe while allowing a competitive marketplace to prosper.

In the other direction, costly, outdated, or overly-burdensome regulations will negatively impact an economy by restricting what type of business inputs are allowed, suppressing creativity, and limiting opportunities for entrepreneurship.

Many regulations place a hidden tax on employers, workers, and consumers that increase the difficulty of making a living. Too much of this bureaucratic red tape is putting new and better jobs out of reach for hardworking Nebraskans, and as a result, the state’s economy is suffering.

Federal, state, and local regulations have a substantial impact on economic activity. The National Association of Manufacturers estimates the aggregate cost of U.S. federal regulations alone is upwards of $2.028 trillion annually.[i] The Mercatus Center at George Mason University calculated that federal regulation reduces the U.S. economy’s Gross Domestic Product (GDP) growth by 0.8 percent annually,[ii] costing everyone meaningful gains of income and living standards over time. [1] Though 0.8 percent may appear insignificant, it is actually greater than the average annual GDP growth most states experienced from 2004–2014.[iii]

Recent data reported by the Bureau of Economic Analysis show Nebraska had two consecutive quarters of negative economic growth in 2016 and 2017[iv]. Nebraska’s state Gross Domestic Product grew 1.1 percent in the 2nd quarter of 2017, or 46th nationally. The revised numbers for previous quarters show that in the first quarter of 2017, the state’s economy contracted 4.5 percent, while the last quarter of 2016 saw a reduction of 1.8 percent.

These newly revised numbers confirm that Nebraska experienced a technical recession in the midst of the agricultural downturn. According to Senior Economist Vance Ginn, Ph.D., “…there’s need for improvement moving forward. By reducing government barriers to competition, Nebraska can be in a better position to withstand economic swings.”

Excessive regulations have harmful effects on prosperity and growth, and Nebraska’s farming economy is a case in point. In many cases, businesses and citizens must comply with these regulations, which cost them valuable resources, and constitutes a hidden tax. Over the years, more and more regulations have been added at the state and federal levels, which has increased the complexity and cost of doing business and has ultimately hindered Nebraska’s economy.

A Study of Nebraska’s Regulations

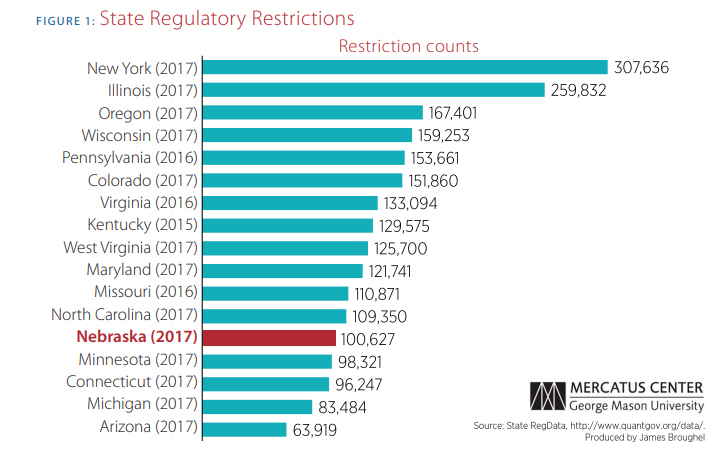

Nebraska’s state regulations are having the same harmful effect on the state’s economy as federal regulations. In fact, Nebraska’s administrative code contains approximately 7.5 million words across 72 different agencies.[v] This is much more regulation than other states that have more people and industries than Nebraska. For example, Michigan has 8 million more people than Nebraska, yet 17,000 fewer regulations.

The Mercatus Center at George Mason University analyzed Nebraska’s regulations[vi] and found that Nebraska’s Administrative code contains 100,627 restrictions. Because literally reading the administrative code is neither practical or timely, researchers at the Mercatus Center have developed a computer program, called State RegData, which reviews state regulations and captures information in minutes that would take an ordinary person many weeks to read.

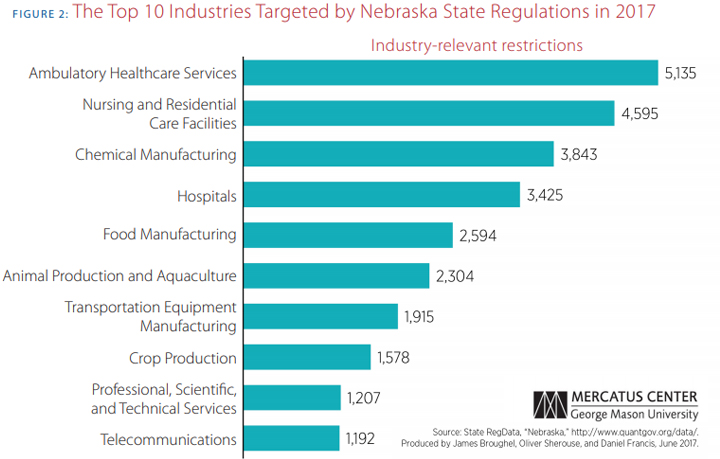

For example, the program allows researchers to identify the industries most targeted by state regulation by connecting text relevant to those industries with counts of words known as regulatory restrictions. These are words and phrases such as “shall,” “must,” “may not,” “prohibited,” and “required” that can signify legal constraints and obligations. As shown in Figure 2, the top three industries with the highest estimates of industry-relevant restrictions in 2017 are ambulatory health care services, nursing and residential care facilities, and chemical manufacturing.

The Beacon Hill Institute examined Nebraska’s regulations from a cost perspective, and through their research[vii], three primary cost burdens were found to impact Nebraska’s private sector, amounting to $473.8 million annually.

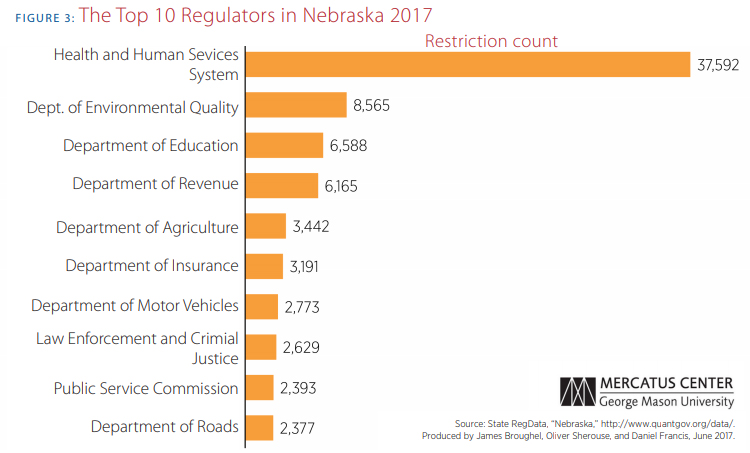

The rules in Nebraska’s Administrative Code are based on the state agency, department or commission that has written them. In Figure 3, we see that rules from the Department of Health and Human Services contained more than 37,000 restrictions making it the largest regulator in Nebraska by this measure. The second largest is the Department of Environmental Quality with more than 8,500 regulations.

The most onerous is the amount paid to the state for fees, licenses and permits amounting to $302.3 million. According to a detailed breakout of licensing fees, permitting fees, and other fees by agency from the State Accounting Office (see Table 1), the State Treasurer has the largest portion of fees, at over $85 million. Next is the Department of Health and Human Services with more than $62 million and the Department of Banking with nearly $30 million. The lowest fee amounts are under the Commission of Industrial Relations and the Board of Examiners for Land Surveyors with less than $3,000 each.

Second is private sector compliance costs incurred by Nebraska’s businesses and households, totaling $110.03 million. The agency costing Nebraska’s private sector the most, at $60.1 million, is also the top regulator in the state: The Department of Health and Human Services. The Department of Motor Vehicles has the second highest costs, at $26.2 million, followed by the Game and Parks Commission, at $6.4 million.

Finally, $63.3 million is expended annually by citizens in Nebraska to regulate their businesses and households.

And while this is a comprehensive analysis, there are many costs that exist in the state that are not measured by the Beacon Hill Institute, which impose another hidden tax. For example, one important factor that is not considered in these calculations is the impact regulations have on the private economy. The money households and businesses spend on fees could be used to finance household consumption and saving. In addition, many businesses have employees or contractors dedicated to navigating a variety of regulations, and the resources spent on these efforts could instead be redirected to producing goods and services.

These represent the opportunity costs of regulations in Nebraska and why the above figures are much lower than the true cost of regulations in the state.

Table 1: Nebraska State Agencies with Revenue from Fees, Licenses and Permits

| Agency Name |

Amount ($) |

| State Treasurer |

85,555,698 |

| Health and Human Services |

62,181,026 |

| Department of Banking |

29,824,054 |

| Game & Parks Commission |

28,209,051 |

| Department of Motor Vehicles |

21,465,970 |

| Department of Insurance |

17,547,199 |

| Environmental Quality |

10,247,889 |

| Department of Roads [2] |

9,885,162 |

| Department of Agriculture |

5,872,314 |

| Workers Compensation Court |

5,466,296 |

| Secretary of State |

4,968,187 |

| Nebraska Brand Committee |

4,538,173 |

| Commission on Public Advocacy |

3,090,507 |

| Department of Labor |

2,060,827 |

| Real Estate Commission |

1,562,245 |

| Nebraska Electrical Board |

1,289,877 |

| Liquor Control Commission |

1,218,948 |

| State Fire Marshal |

1,059,402 |

| Department of Revenue |

839,123 |

| Commission Law Enforcement |

830,084 |

| Motor Vehicle Industrial License Board |

755,593 |

| Department of Education |

702,964 |

| St Board of Exam Engineer & Architects |

633,870 |

| Public Service Commission |

529,232 |

| Board Pub Accountancy |

359,728 |

| Real Property Appraiser Board |

324,989 |

| Department of Natural Resources |

289,458 |

| NE Actability & Discipline Commission |

181,508 |

| Board of Education, Lands & Funds |

151,856 |

| Board of Barber Examiners |

148,905 |

| Department Veterans Affairs |

106,728 |

| Board of Exam-Abstractors |

74,575 |

| Oil & Gas Conservation Commission |

67,834 |

| State Historical Society |

65,282 |

| Blind/Visually Impaired Commission |

47,806 |

| Tax Equalization & Review |

45,585 |

| State Racing Commission |

43,985 |

| Board of Geologists |

28,178 |

| Landscape Architects |

26,305 |

| Department of Aeronautics¹ |

15,716 |

| Post-Secondary Education Commission |

13,550 |

| Commission Deaf/Hard of Hearing |

10,980 |

| Energy Agency |

10,964 |

| Commission of Industrial Relations |

2,600 |

| Board of Examiners for Land Surveyors |

2,585 |

| Total |

$ 302,352,808 |

Occupational Licensing

While some regulation will always be essential, regulatory policy should not unnecessarily limit entry into occupations or industries in a manner that lessens competition. One area of Nebraska’s regulatory system that creates these barriers for entrepreneurs is the state’s occupational licensing laws. In a national study, Nebraska fell in the worst of the five categories for the number of occupations requiring licenses,[viii] which is not surprising since almost 200 different jobs[ix] in Nebraska require a government license.

When taking an in-depth look at Nebraska’s regulations, it was found that the agencies with the highest total fees are those that are collecting fees from the most people. For example, the Department of Health and Human Services issues licenses or registrations for over 51 different occupations. Some of these licenses are for occupations that would not require advanced training, such as a purveyor of body art, a swimming pool operator, a paid dining assistant at a skilled nursing facility, or a water operator.[x] Another example of the high fees associated with excessive licensing are those collected by the Departments of Banking and Transportation, who have the third and fifth highest amount of fees collected, as shown in Table 1. Some of these fees have been recently curtailed by the Nebraska Legislature. State licensing for Executive Bank Officers and Motor Vehicle Salespeople were addressed by two bills in the 2017 legislative session. Both licenses were found to have a regulatory burden that far outweighed any benefits derived from their existence. Consequently, the Executive Bank Officer license was made optional, and the Motor Vehicle Salesperson license was eliminated.[xi]

A study by the Heritage Foundation found that comprehensively reforming Nebraska’s occupational licensing laws could save the average household $942 a year.[xii] These higher costs on Nebraska’s workforce discourage low-income workers, small business people, relocating military families and workers, and ex-offenders from pursuing career or business opportunities that require licensing. Because these disincentives to work and invest reduce competition in numerous professional fields, consumers also pay higher prices for these services.

Government Action in Nebraska

Shortly after the release of the Mercatus analysis, Governor Pete Ricketts held a press conference where he signed an executive order to initiate a review of state regulations. According to the executive order[xiii], each agency in Nebraska’s state government was to follow these directives for the remainder of 2017:

- Every state agency shall immediately suspend all rulemaking. Exceptions are made for critical regulations and those mandated by statute.

- Every state agency shall conduct a review of all existing and pending agency regulations.

- Every state agency shall submit a report to the Governor’s Office by November 15, 2017 for each existing or proposed regulation.

- Any regulation deemed to be more restrictive than required under state or federal law, or that creates an undue burden on Nebraskans, shall be revised or repealed.

The governor also named four individuals to an advisory task force that will be in control of reviewing the information and regulations and subsequently, offering their opinions and suggestions for reform. These members are:

- Government Committee Chair Senator John Murante

- Nebraska Department of Banking and Finance Director Mark Quandahl

- Nebraska Tax Commissioner Tony Fulton

- Nebraska Department of Health and Human Services Chief Operating Officer Bo Botelho

The details of how the regulations will be reviewed were not mentioned. Ideally, a cost-benefit test should be conducted on whether the regulation creates more benefits than harm to the state’s economy. While the order calls for executive action to address regulations deemed to be more burdensome than required by law, task force member and State Sen. John Murante has also stated that he intends on drafting legislation[xiv] to be introduced into the 2018 legislative session to address some of the problems they find with regulation during the review process.

Conclusion

It is clear that both federal and state regulations harm economic growth, and while Nebraska cannot control the federal regulations, it can control its own. States like Nebraska write millions of additional words of regulation and hundreds of thousands of additional restrictions on top of the federally mandated regulations. State-level requirements carry the force of law to restrict individuals and businesses just as federal ones do.

Nebraska‘s state regulations come with a significant burden or hidden tax on both businesses and consumers, putting up barriers that have impeded the state’s economic growth. In a time when Nebraska is not experiencing robust economic growth, something must be done to provide Nebraska businesses and citizens the opportunities to reach their full potential and ultimately better the state’s economy.

The research done by both the Beacon Hill Institute and the Mercatus Center is important because it sheds light on the state’s current regulatory atmosphere. Hopefully with this information, along with the regulatory review conducted by the governor’s task force, Nebraska will have the tools necessary to take steps to reform the regulatory climate in the state and allow a more competitive marketplace to prosper. Regulation is a necessity of our society, but Nebraska needs to make sure its regulations are not excessive to the point of inhibiting economic growth or putting up barriers to those with an entrepreneurial spirit.

Appendix

The Beacon Hill Institute: The Cost of Regulation in the State of Nebraska – https://files.platteinstitute.org/uploads/2020/05/The-Cost-of-Regulation-in-the-State-of-Nebraska.pdf

Mercatus Center at George Mason University: A Snapshot of Nebraska Regulation in 2017 – https://www.mercatus.org/publications/snapshot-nebraska-regulation-2017

End Notes

[1] According to the study by Mercatus, since 1980, America’s gross domestic product saw an average reduction in its annual growth rate of 0.8 percent due to regulation. Essentially, if regulation had been held constant at levels observed in 1980, the US economy would have been about 25 percent larger than it actually was in 2012.

[2] The Department of Roads and the Department of Aeronautics were merged on July 1, 2017 into the Nebraska Department of Transportation.

[i] National Association of Manufacturers, The Cost of Federal Regulation to the U.S. Economy, Manufacturers, and Small Businesses, http://www.nam.org/Data-and-Reports/Cost-of-Federal-Regulations/Federal-Regulation-Full-Study.pdf, (September 10, 2014).

[ii] Bentley Coffey, Patrick McLaughlin, Pietro Peretto, The Cumulative Cost of Regulations, April 26, 2016, http://mercatus.org/publication/cumulative-cost-regulations.

[iii] Platte Institute, Removing Barriers in Nebraska, Part One: Why Growing Nebraska Matters, June 29, 2016, http://www.platteinstitute.org/research/detail/removing-barriersin-nebraska-part-one-why-growing-nebraska-matters.

[iv] Adam Weinberg, Give Thanks: Following a Recession, Nebraska is Growing Again, Press Release, November 21, 2017, http://www.platteinstitute.org/research/detail/give-thanks-following-a-recession-nebraska-is-growing-again.

[v] James Broughel and Daniel Francis, A Snapshot of Nebraska Regulation in 2017, Mercatus Center at George Mason University, July 6, 2017, https://www.mercatus.org/publications/snapshot-nebraska-regulation-2017.

[vi] Ibid.

[vii] Paul Bachman and David Tuerck, The Cost of Regulation in the State of Nebraska, April 2017, page 2, https://files.platteinstitute.org/uploads/2020/05/The-Cost-of-Regulation-in-the-State-of-Nebraska.pdf.

[viii] Adam B. Summers, Occupational Licensing: Ranking the States and Exploring Alternatives, August 2007, Washington, DC: Reason, http://reason.org/files/762c8fe96431b6fa5e27ca64eaa1818b.pdf.

[ix] Nebraska Department of Labor, Licensed Occupations in Nebraska 2015, https://neworks.nebraska.gov/admin/gsipub/htmlarea/uploads/Licensed-Final.pdf.

[x] Nebraska Department of Health and Human Services, Licensure Unit, http://dhhs.ne.gov/publichealth/Pages/crl_crlindex.aspx.

[xi] Sarah Curry, Strong Jobs Nebraska: The 2017 Occupational Licensing Review, Platte Institute, July 11, 2017, http://www.platteinstitute.org/research/detail/strong-jobs-nebraska-the-2017-occupational-licensing-review.

[xii] Salim Furth, Costly Mistakes: How Bad Policies Raise the Cost of Living, November 23, 2015, Heritage Foundation, http://www.heritage.org/research/reports/2015/11/costlymistakes-how-bad-policies-raise-the-cost-of-living.

[xiii] State of Nebraska Office of the Governor, Executive Order No. 17-04: Regulatory Reform, July 6, 2017, https://governor.nebraska.gov/sites/governor.nebraska.gov/files/doc/press/Red%20Tape%20Review%20Executive%20Order%202017.pdf.

[xiv] At the Platte Institute’s Legislative Summit on September 26, 2017 Senator Murante alluded that he would be drafting legislation as a result of the advisory task force.